RMB inclusion into the SDR basket benefits China and IMF

- By Zhang Jingwei

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, November 28, 2015

E-mail China.org.cn, November 28, 2015

|

|

|

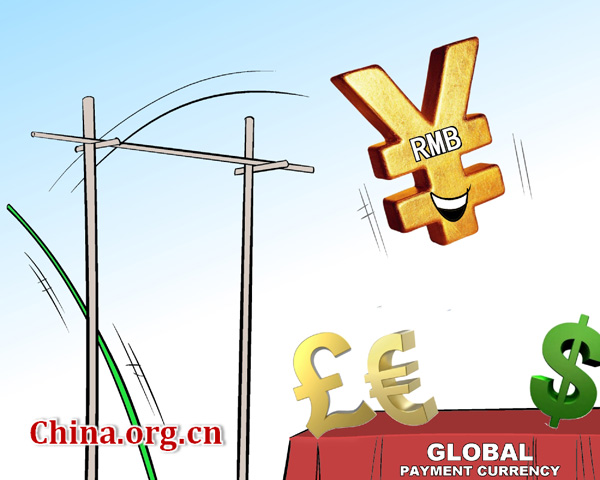

Vaulting into the global ranks [By Jiao Haiyang/China.org.cn] |

Recently, Christine Lagarde, chief of the International Monetary Fund (IMF), said in a statement that the Chinese yuan, or the renminbi (RMB), has met the requirements of a "freely usable" currency.

Ms Lagarde reiterated her support for the IMF's recommendation to include the RMB into the Special Drawing Right (SDR) basket as its fifth currency following the U.S. dollar, British pound, the Euro, and the Japanese yen.

So far, the IMF's recommendation has been the most definitive voice given by the organization. It signals a foregone conclusion that the RMB will be included into the SDR basket.

When conditions are ripe, success is assured

Five years ago, China made its first move towards the RMB's inclusion into the SDR basket. However, it was voted down for the reason that the RMB "was not freely convertible" - a hard index which has instead accelerated the internationalization of RMB in the past few years.

It is worth mentioning that the move towards the RMB's inclusion into the SDR basket is only an external cause which becomes operative through many internal causes in the internationalization of the RMB.

Since the 18th CPC National Congress in November 2012, China has strengthened the reforms on the exchange rate market and the interest rate market, which are not only the need of the financial system reform at home, but also the need of the internationalization of the RMB.

The promotion of the "Belt and Road Initiative" and the operation of the Asian Infrastructure Investment Bank (AIIB) as well as the establishment of four free trade pilot zones at home [namely in Guangdong, Tianjin, Fujian and Shanghai] mean that the internationalization of the RMB has become the core theme and most urgent task of China's reform policies.

In August of this year, the People's Bank of China (PBC), China's central bank, allowed its currency to trade in a range around the middle rate. On October 24, the PBC lowered the benchmark interest rates of RMB loans and deposits of financial institutions. Moreover, the PBC also decided not to set up floating ceilings on commercial banks and rural cooperative financial institutions any longer. At this point, the marketization of the RMB's interest rates had basically been completed.

Deeply docking with overseas markets to realize the globalization of China's financial system has a direct bearing not only on the country's "Belt and Road Initiative," but also on its social and economic governance. RMB's internationalization is the goal, while its inclusion into the SDR basket is the international community's recognition of RMB.

Go to Forum >>0 Comment(s)